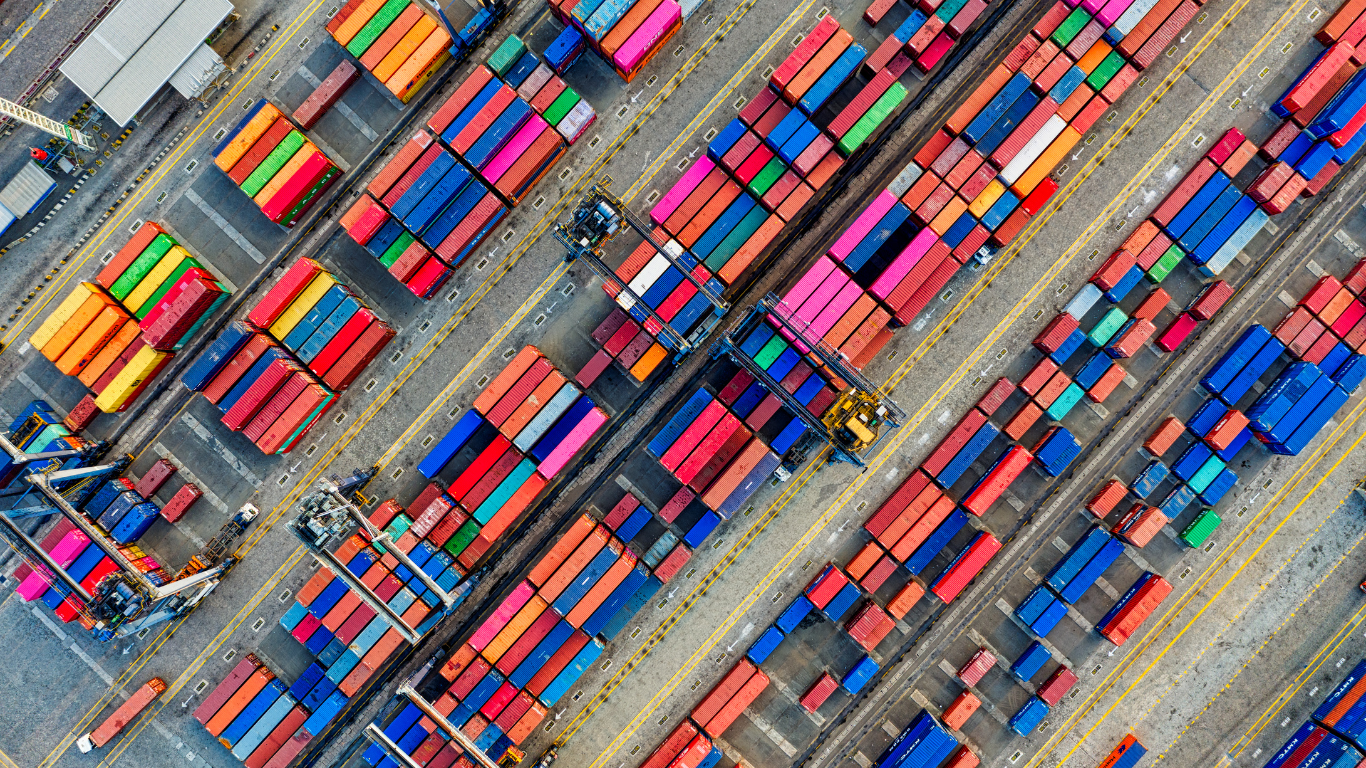

The Authorized Economic Operator (AEO) status is a valuable recognition granted to businesses involved in cross-border trade within the European Union (EU). Whether you’re an SME or a multinational, obtaining AEO status demonstrates that your customs procedures and supply chain security meet high European and international standards.

This certification not only enhances your credibility with customs authorities and business partners, but also allows you to benefit from simplified procedures and a faster customs clearance process. It’s a proactive way to assess, structure, and strengthen your internal processes related to customs and security.

Curious about how to get started, what the requirements are, and what the long-term advantages look like? You’re in the right place. We would be delighted to accompany you on this journey.

Contact us